average property tax in france

For properties more than 5 years old stamp duty is 58 or 509 in some departments. Heres what you need to know about French property taxes including your tax-paying responsibilities tax rates and how to pay your property tax bills.

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

In 2019 homeowners paid an average of 3561 raising 3064 billion.

. The standard TVA rate in France is 20. During that period the highest tax-. This places France on the 11th place in the International Labour Organisation statistics for 2012 after the United Kingdom but before Germany.

The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property. ATTOM Data Solutions provides a county-level heat map. Corporation tax in France.

For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. Check all the suggestions below with your English speaking French real estate professional. The figure is based on the rental value of the property and the rate of tax is determined annually by the authority.

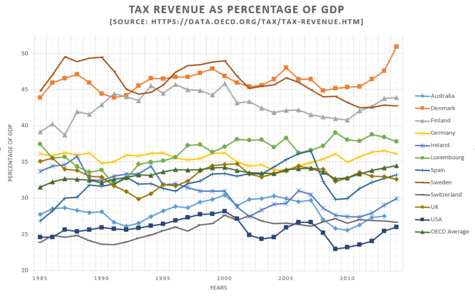

The tax-to-GDP ratio in France has increased from 434 in 2000 to 454 in 2020. Income Tax Rates and Thresholds Annual Tax Rate. Average single worker no children TAX WEDGE ON LABOUR INCOME Average tax wedge.

Over the same period the OECD average in 2020 was slightly above that in 2000 335 compared with 329. OECD average tax wedge in 2020 was 346 2019 350. Obviously all countries have a different way of calculating taxes and different tax segments.

This tax is actually comprised of the. In short location is the biggest factor affecting property prices. Therefore to compare these two countries lets take the salaries of someone who gains 28 000 a year 45 000 a year and 113 000 a year and see how much they have left after taxes in each country.

How to file a tax return in France. France Residents Income Tax Tables in 2020. Rental and related investment income from France and taxable in France beyond this level is taxed at 30.

There is no exemption. Taxes on goods and services VAT in France. The average monthly net salary in France is around 2 157 EUR with a minimum income of 1 149 EUR per month.

Taxe sur la valeur ajoutée or TVA VAT in French is a tax on certain goods and services which is included in the sale price. In 2020 the FNAIM Frances National Association of Estate Agents reported average national house prices of 2276 per square metre while this soars to over 10000 per square metre in the Paris region. Between 2019 and 2020 the OECD average slightly increased from 334 to 335.

There are no local taxes on personal income in France. Points from 449 in 2019 to 454 in 2020. These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237.

If you purchase an older property anything older than 15 years youll pay between 7-10 of the propertys value in tax. However there are reduced French TVA rates for certain pharmaceuticals public transport hotels restaurants and tickets to sportingcultural events. Have you seen our French real estate buyers guide that comes with a 100 percent money back guarantee.

France is notorious for being one of the highest tax-paying countries in Europe so it should come as no surprise that as there are taxes to pay as a French homeowner. It concerns about one-third of French companies. The standard rate is.

Like income tax property tax in France is a headache with the French apparently having a taste for making these processes as complicated as possible. Unlike most EU member states France does not withhold income taxes from the monthly income although social. Any owner of real estate in France on 1 st January of the taxation year must pay the property tax during the last quarter of the same year after receipt of his tax notice.

Aggregate Local Property Tax Stats. Buyers in Paris will have to pay stamp duties on the purchase according to Jessica Duterlay a tax associate at Attorney-Counsel a. For properties less than 5 years old stamp duty is 07 plus VAT at 20.

In 2020 France had the 4th highest tax wedge among the 37 OECD member countries compared with the 5th in 2019. Taxes in France are high and the capital city is no exception. For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise.

Remember tax rules in France change frequently. This is a land tax and and is always paid by whoever owns the property on January 1st of any given fiscal year. Property Taxes Taxe Foncière.

Property owners in France have two types of annual tax to pay. This raised 323 billion in property taxes across the nation. Local income taxes.

One-earner married couple at average earnings 2 children. Any person living abroad and owner of real estate in France is subject to French property tax. Here is how it is calculated.

As a result of simultaneous changes to the liability for social charges since 2019 the combined rate of social charges and income tax on French sourced income of EEA non-residents is 275 down from 372 provided the income does not exceed the above threshold. Average price per hectare of free land and meadows in Ile-de-France 2016-2018. However there are local taxes on housing for individuals occupying or renting housing in France on 1 January of the tax year see Property taxes in the Other taxes section for more information.

For new builds this rate is 2-3. The corporate tax in French impot sur les societes IS is an annual tax in principle that affects all profits made in France by corporations and other entities. Email your questions to editors.

Average price per hectare of free land and meadows in Brittany 2016-2018. In 2020 the average single-family home in the United States had 3719 in property taxes for an effective rate of 11.

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

How Do Taxes Affect Income Inequality Tax Policy Center

A Two Speed Recovery Global Housing Markets Since The Great Recession Housing Market Global Home Global

Foreign Buyers Push Up Global House Prices Charts And Graphs Economics Economist

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

Credit Suisse Defines Net Worth As The Market Value Of All Assets Minus Any Outstanding Debts Researchers Calculated Inequality Image Chart Developing Country

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

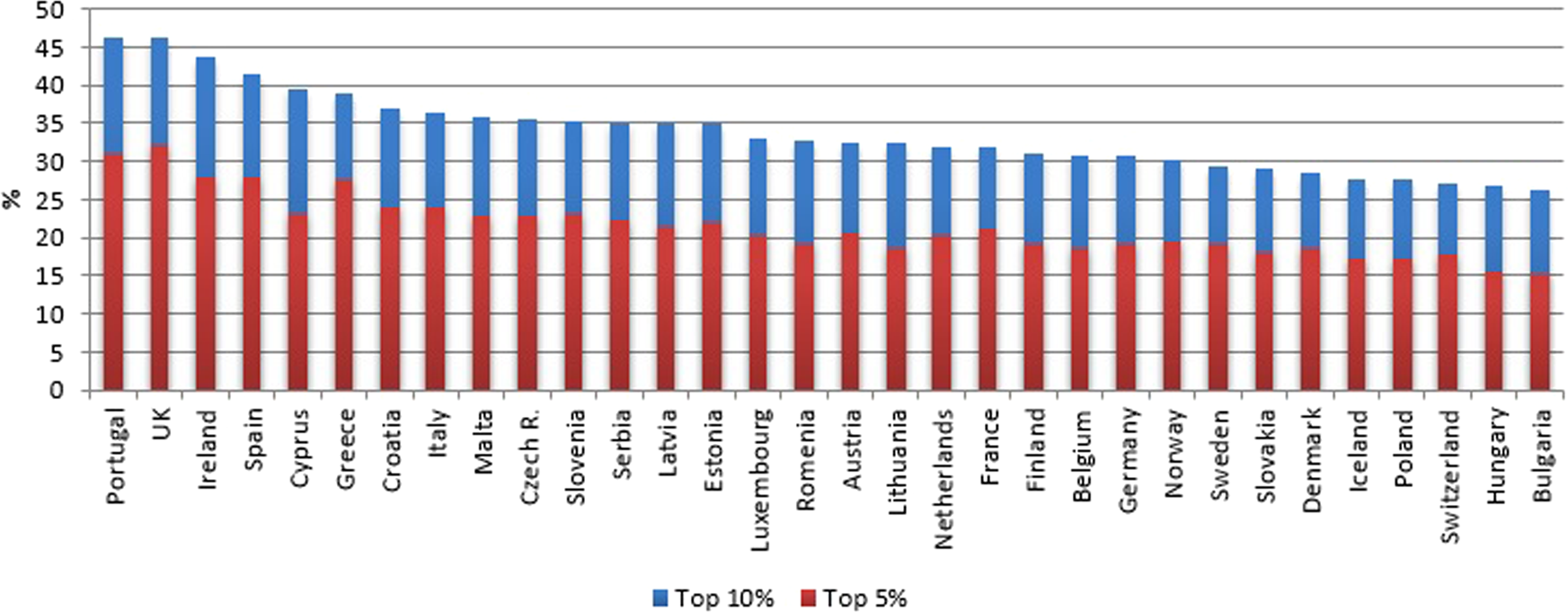

Four Profiles Of Inequality And Tax Redistribution In Europe Humanities And Social Sciences Communications

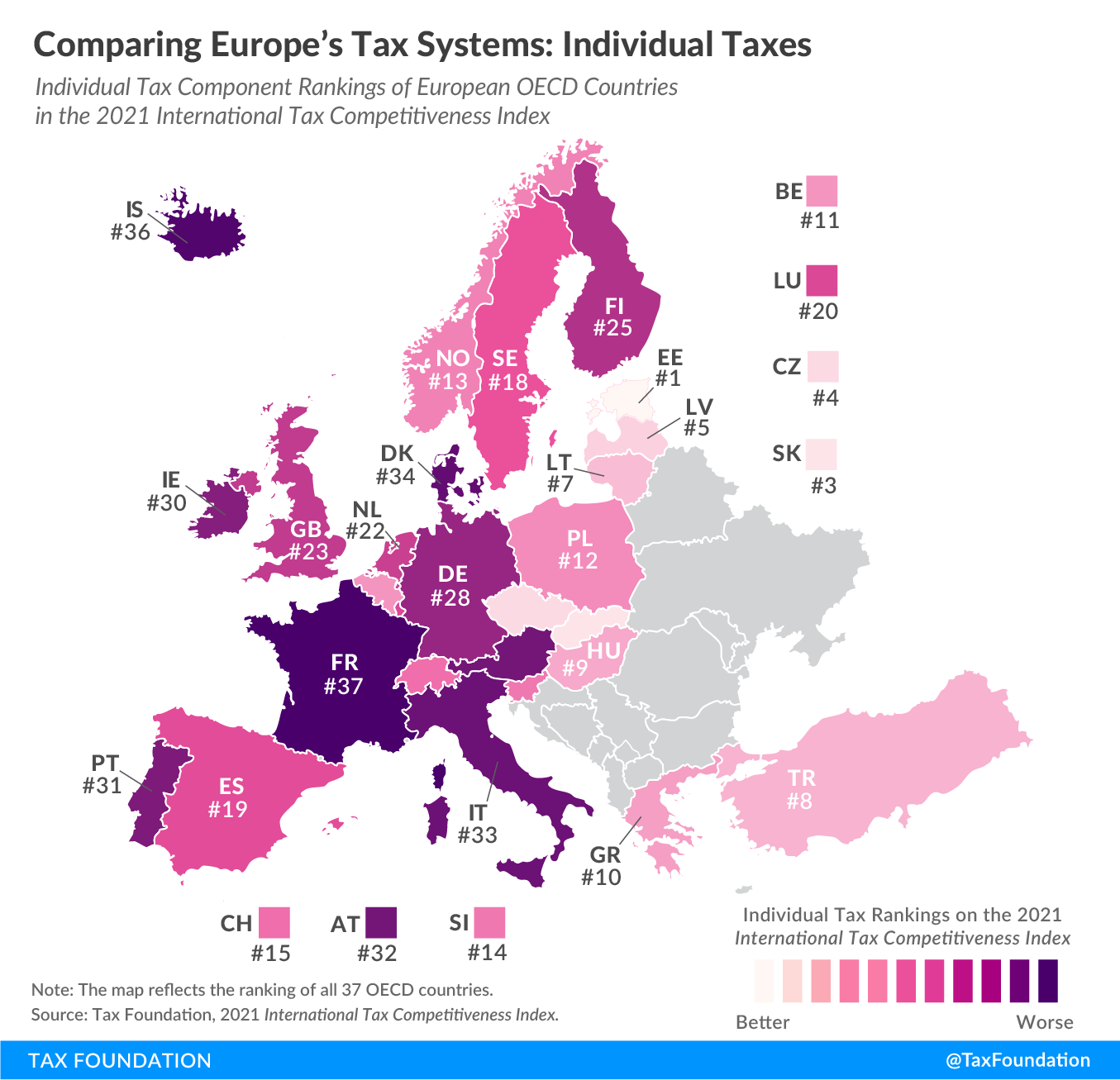

Comparing Income Tax Systems In Europe 2021 Tax Foundation

Average Appraisal Is Half Of A Percent Less Than Expected Rocket Mortgage Press Room Quicken Loans Home Refinance Home Appraisal

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

Family Structure Matters More For U S Students Single Parent Families Single Parenting Family Education

France S Weak Economic Performance Sick Of Taxation Vox Cepr Policy Portal

Tax Day2015 Tax Day Real Estate Infographic Real Estate Fun

Ecuador El Mejor Lugar Para Migrar Expat Destinations Infographic Ecuador Expat Cool Countries