working capital turnover ratio ideal

A higher ratio indicates a strong financial outlook for your company as the funds spent have generated an ideal number of net sales over the period. All businesses are different of course.

Working Capital Turnover Ratio Different Examples With Advantages

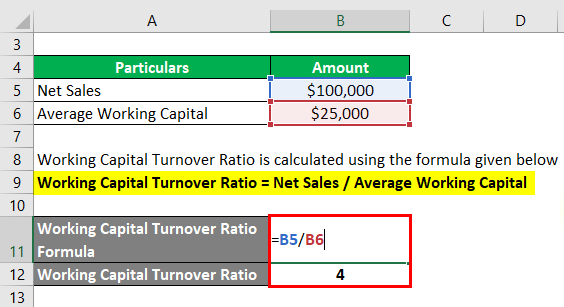

Putting the values in the formula of working capital turnover ratio we get.

. The formula to determine the companys working capital turnover ratio is as follows. Multiply the days in a normal working week for you by 56. 420000 60000.

This means that XYZ Companys working capital turnover ratio for the calendar year was 2. Working capital turnover ratio Net Sales Average working capital. Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period.

Company B 2850 -180 -158x. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. This means that company is not using its resources efficiently to generate sales.

It indicates a companys effectiveness in using its working capital. Say Company A had net sales of 750000 last year and working capital of 75000. Most analysts consider the ideal working capital ratio to be between 15 and 2.

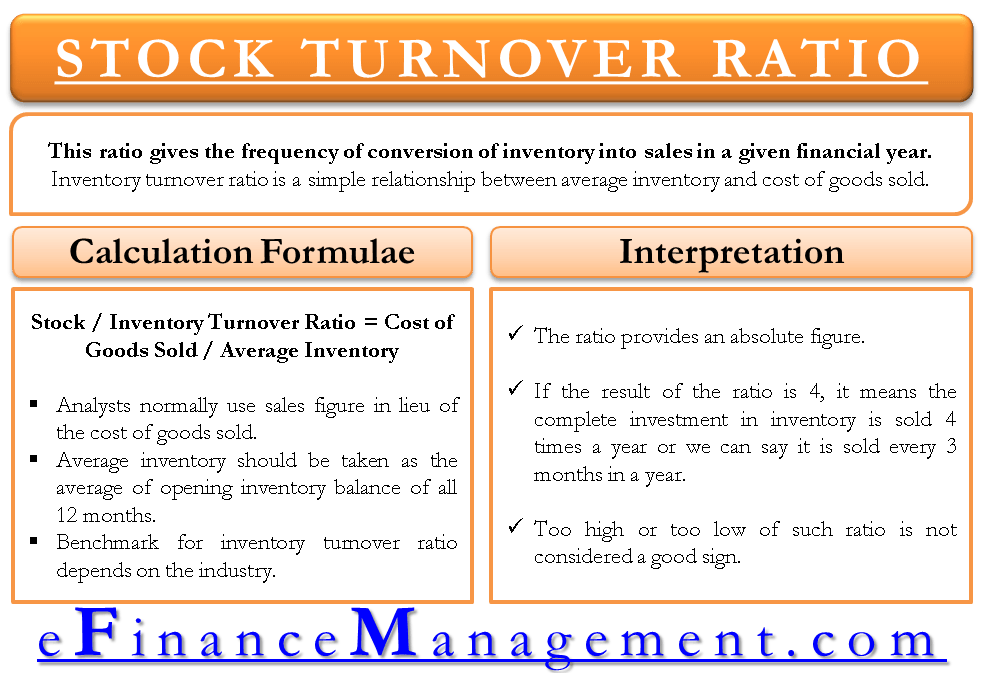

As with other performance metrics it is important to compare a companys ratio to those of similar companies within. For many ecommerce businesses the ideal inventory turnover ratio is about 4 to 6. This shows that for every 1 unit of working capital employed the business generated 3 units of net sales.

The ratio is calculated by dividing current assets by current liabilities. The term receivables turnover ratio refers to an accounting measure that quantifies a companys effectiveness in collecting its accounts receivable. A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities to support sales.

Working Capital Turnover 8 billion 148 billion 125 billion 2 The working capital turnover ratio for 2018 was 58 or 58 for every 100 dollar of sales. The following formula is used to measure the ratio. 150000 divided by 75000 2.

For many ecommerce businesses the ideal inventory turnover ratio is about 4 to 6. Working Capital Turnover Ratio Turnover Net Sales Working Capital. The funds 6 turnover ratio is a fraction of the 55 to 87 turnover.

However if working capital turnover rises too high it could suggest. A D V E R T I S E M E N T. Working capital is current assets minus current liabilities.

It means each dollar invested in working capital has contributed 214 towards total sales revenue. This means that for every 1 spent on the business it is providing net sales of 7. A low ratio indicates inefficient utilization of working capital during the period.

15000050000 31 or 31 or 3 Times. Determining a Good Working Capital Ratio. Once you understand what working capital and turnover mean it will be easy for you to understand the purpose of the ideal working.

Is below 10 and is not considered an ideal ratio because the working capital turnover is preferred above 10. It is also referred to as the current ratio. This ratio measures how well a company uses and.

Net Sales or Turnover Gross Sales Discounts Credit Note Taxes. Turnover is an important factor when calculating various ratios. The working capital turnover ratio of XYZ Co.

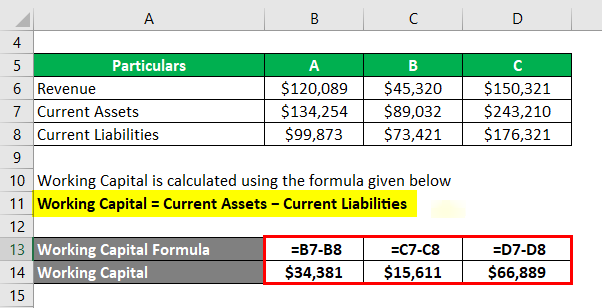

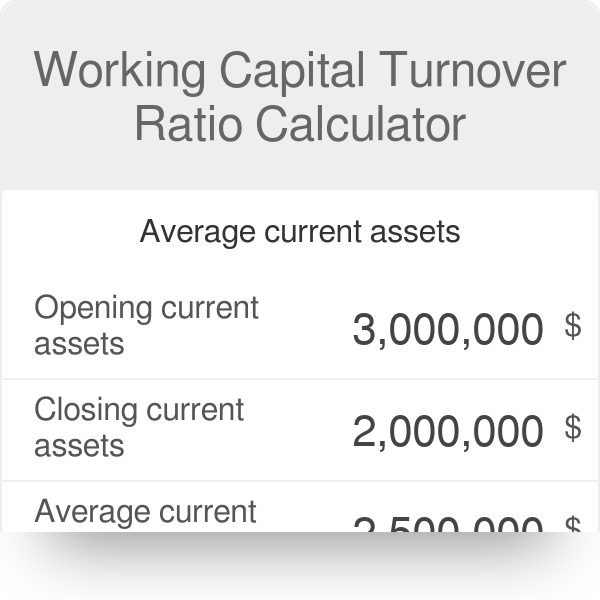

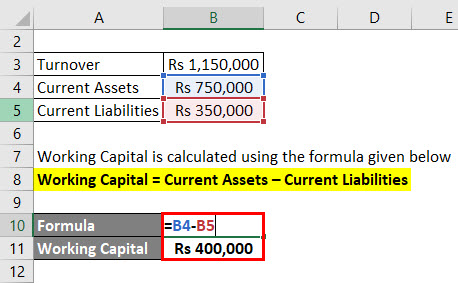

Now working capital Current assets Current liabilities. Average working capital equals working capital at the beginning of the. Working capital Turnover ratio Net Sales Working Capital.

A higher working capital turnover ratio is better and indicates that a company is able to generate a larger amount of sales. A ratio of 2 is typically an indicator that the company can pay its current liabilities and still maintain its day-to-day operations. Working capital turnover of a business is the net sales of the business.

What your Working Capital Turnover Ratio Means. All businesses are different of course but in general a ratio between 4 and 6 usually means that the. Furthermore it may also mean that the company is not managing its working capital properly.

The goal here is to have a high ratio of working capital turnover. The working capital turnover ratio equals net sales for the year -- or sales minus refunds and discounts -- divided by average working capital. Working Capital Turnover Ratio Rs 1150000 Rs 400000.

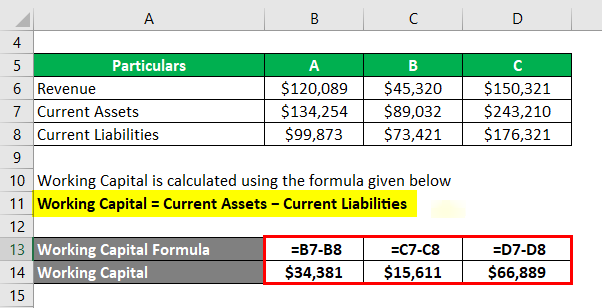

What this means is that Company A was more efficient in generating Revenue by utilizing its working. 100000 40000. The working capital turnover ratio is also referred to as net sales to working capital.

The working capital turnover ratio of Exide company is 214. Some startups however may have calculated their working capital turnover ratio. The ideal quick ratio is considered to be 11 so that the firm is able to pay off all quick assets with no liquidity problems ie.

Working Capital Turnover Ratio 288. Working Capital Turnover Ratio Net SalesWorking Capital. Now that we know all the values let us calculate the Working capital turnover ratio for both the companies.

Lets look at a couple working capital turnover ratio examples to bring some context as to why this metric is so useful for measuring efficiency. For 2018 total returns equaled just over 8 billion. Working capital turnover ratio examples.

Generally a high working capital turnover ratio is better. Company A 1800340 20x.

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Cycle Efinancemanagement

Working Capital Turnover Ratio Calculator

Working Capital Turnover Efinancemanagement Com

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio College Adventures Interpretation Ratio

Working Capital Turnover Ratio Meaning Formula Calculation

Stock Inventory Turnover Ratio Calculate Formula Benchmark

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratios Universal Cpa Review